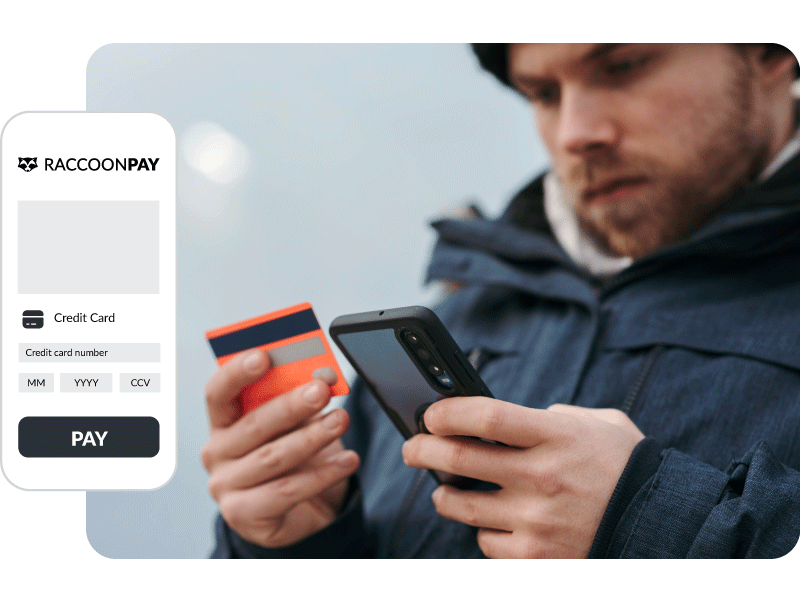

RaccoonPay: Fast, secure hotel payment processing solution

More ways to get you paid.

Diversify Your Hotel Payment Channels

You deserve success. You also deserve options.

Transform your hotel operations with a payment processing system as unique as your guest journey.

Whether it's seamless website transactions or in-person payments, our system empowers you with flexible payment channels to reach more guests.

RaccoonPay Payment Channels

Booking proposal

Simplify how you manage quotes with a booking proposal document complete with stay details, a payment request, and an expiration date.

Hotel website payments

Process secure payments and authorize credit cards directly on your website with RoomRaccoon’s integrated hotel booking engine.

Booking channel payments

Centralize VCCs from OTAs imported via our channel manager and auto-charge cards on the activation date to never miss out on revenue.

Payment request links

Is payment due? Customize digital payment request templates and send them straight to guests’ inboxes — all on autopilot.

Online check-in/out

Whether it's arrival or departure, take control. Enjoy flexibility by processing payments before guests arrive and at the time of departure.

In-person payments

Let your guests tap, insert, and swipe for a seamless experience that’s error-free! The integrated RaccoonPay Card Machine is ideal for any front desk.

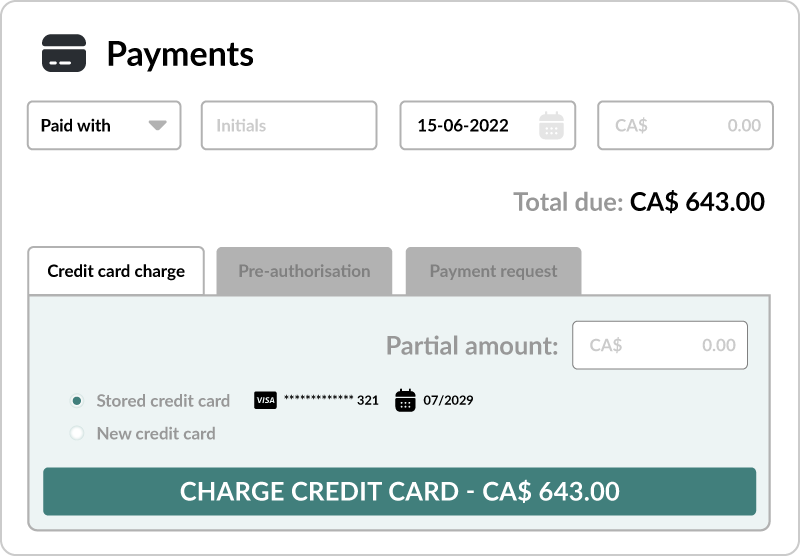

One-click payments from the guest reservation card

View all the vital info from our guest reservation card—and take action!

A single click lets you process payments from stored cards, send payment requests, or effortlessly initiate card-present payments using the integrated RaccoonPay Card Machine.

Simplify the Switch With RaccoonPay Self-Onboarding

Switching to a new payment solution is a breeze with RaccoonPay's self-onboarding dashboard. Just follow a few simple steps:

• Fill in your business information

• Upload documents

• Submit them for review

• Start taking payments in as little as 24 hours!

No set-up fees, zero monthly costs – just a small fee per transaction.

Centralize Your Payment Data

Run your business confidently, knowing you have complete financial oversight with a user-friendly dashboard featuring tabs for all payments, payouts, a cash drawer, virtual credit cards (VCCs), and reporting—all in one place.

Say goodbye to hunting for scattered payment information and breeze through reconciliation.

Additional Features

All payments

Get a snapshot of all payment activity, including real-time statuses and payment methods for each reservation number.

Virtual credit cards

Track imported VCCs from booking channels and enable auto-charge upon card activation—never miss out on revenue!

Refunds

Effortlessly initiate one-click refunds for the full or partial amount, ensuring swift and hassle-free reimbursement for your guests!

Real-time reporting

Track popular payment methods and generate a Daily Management Report for a breakdown of daily payments and revenue groups.

Payouts

Experience the convenience of weekly payouts, enhancing your cash flow, and get updates on your settlements in the payments overview.

Chargebacks

Access a comprehensive dashboard that allows you to easily monitor, manage, and dispute any chargebacks that may occur.

Pay it Safe with Advanced Hotel Payment Processing Technology

RaccoonPay’s hotel payment software captures and stores sensitive data safely.

We merge industry-leading security standards and automation to reduce the risk of fraud, identity theft, and illicit activities.

Additional Features

PCI compliance

RaccoonPay is a PCI DSS v4.0 Level 1 Service Provider, ensuring that every payment made on our platform is absolutely secure.

Pre-authorization

Verify credit cards to ensure validity and hold funds for a short period to collect a breakage fee if required.

3D-secure payments

We add extra layers of security to hotel transactions with automatic two-factor customer authentication via a 3D Secure process.

Tokenization

We encrypt and store confidential card information as a token for future charges.

User permissions

Customize your user logins to provide access or restrict control for specific functions within the system, like processing refunds.

Point-to-point encryption

Transaction encryption from the point of sale to the endpoint, preventing data breaches along the way.

Elevate Your Front Desk Experience with Effortless, Error-Free Payments

The RaccoonPay Card Machine is sleek, modern, ultra-durable, and the perfect addition to your front desk.

Integrate payments with us for speedy, error-free experiences. Faster payments, delighted guests – it's that simple!

- WiFi-enabled

- Built-in printer

- Tap and go

- Mobile payments

- Large touchscreen for ease-of-use

Resources: Hotel Payments

RaccoonPay: A Hotel Payment Processing Guide

Hotels and other accommodation businesses deal with payments every day. But, unlike most businesses, hotels face unique challenges when it...

Navigating Secure Online Payment Processing: Strategies for Hoteliers

Over the years, hotels have increasingly shifted their operations into the digital space. This has resulted in significant changes in the way guests...

FAQ: RaccoonPay Hotel Payment Processing System

RaccoonPay uses the power of automation to streamline online payment procedures, enhance guest experiences, and ensure the security of sensitive financial data.

Our payment processing software supports multiple payment options, such as credit/debit cards, cash, and mobile payments. It verifies the payment details and ensures transaction security through advanced payment technology like 3D Secure. As hotel payments are unique, we provide hotel-specific features, including a VCC dashboard, chargeback dashboard, and special ways to collect payments at important guest touchpoints such as online check-in and booking proposal documents.

With RaccoonPay, you'll have complete autonomy when it comes to managing your account details. Be it updating your bank account information or making ownership changes, you can do it all with ease and in just a few clicks.

Here are some more benefits of VCC for hotels:

• VCCs hold temporary account details valid for one purchase, making them hack-proof.

• Payment data such as date, amount, and the purchaser is attached to the credit card number transfer.

• VCCs process payments faster than traditional credit cards for speedier reconciliation.

• VCC activation date

• OTAs that issued the VCC

• Cancelled VCCs

• Available balance in the VCC and what is due to be charged.

Better yet, you can enable auto-charge upon card activation. This means the system will auto-charge VCCs on the morning of the effective payment date, so you don't have to worry about forgetting and missing out.

All cards with a VCC balance higher than zero will be charged on the day of the effective payment date. This is subjective to each property and your contract with the OTA. All cards will be charged in the morning, and the overview will be ready when you start your day.

In addition, a small fee will be applied to card transactions. RaccoonPay offers transparent interchange plus plus and blended rates.